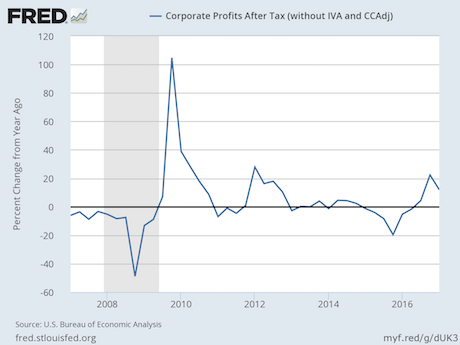

Corporate profits are rolling over again.

Two years ago, corporations posted their first year of negative profit growth since the Great Crisis. We had a bounce from those depressed levels, which suckered a lot of investors into believing that fundamentals were improving.

They were wrong. That bounce has now ended. Year over year profits are rolling over HARD.

Why does this matter? After all, corporate profits have rolled over several times in the last few years… and the markets kept blasting off to new highs.

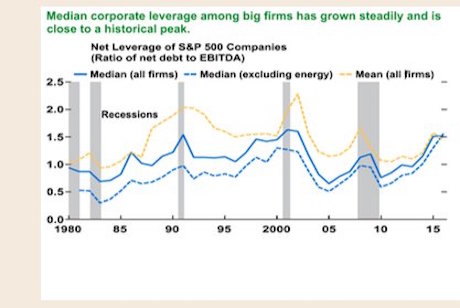

This time is different… because profits are rolling over at a time when corporate leverage is nearing all time highs.

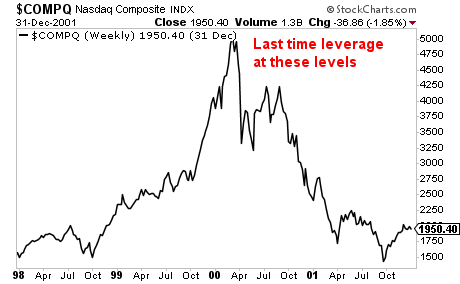

As the IMF has noted, the median Net Leverage to EBITDA for S&P 500 companies is close to 1.5. The last time we were anywhere NEAR these levels was at the absolute PEAK of the Tech Bubble in 2000.

We all remember what came next don’t we?

A Crash is coming… it’s going to horrific.

Written by The Phoenix

Source